Mutual fund expense ratio calculator

Remember that these higher fees contribute to the fact that 80-90 of actively managed funds underperform. One of the few investment outcomes that is completely in your control is expenses.

Portfolio Mer Calculator Squawkfox

The Financial Industry Regulatory Authority FINRA Fund Analyzer offers information and analysis on over 18000 mutual funds exchange traded funds ETFs and exchange traded notes ETNs.

. 05 to 075 Expense Ratio for an actively managed portfolio is considered to be a good one and beneficial for the investors. For example the average expense ratio. Meeting Your Long-Term Investment Goals Is Dependent On A Number Of Factors.

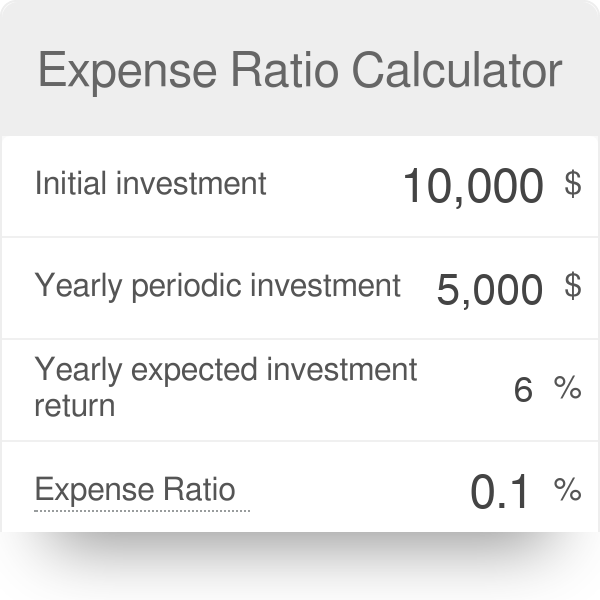

By using the Cost Calculator investors will find answers quickly to questions like this. The expense ratio is a measure of the total operating expenses for a mutual fund or ETF. This mutual fund fees calculator can help analyze the costs associated with buying shares in a mutual fund.

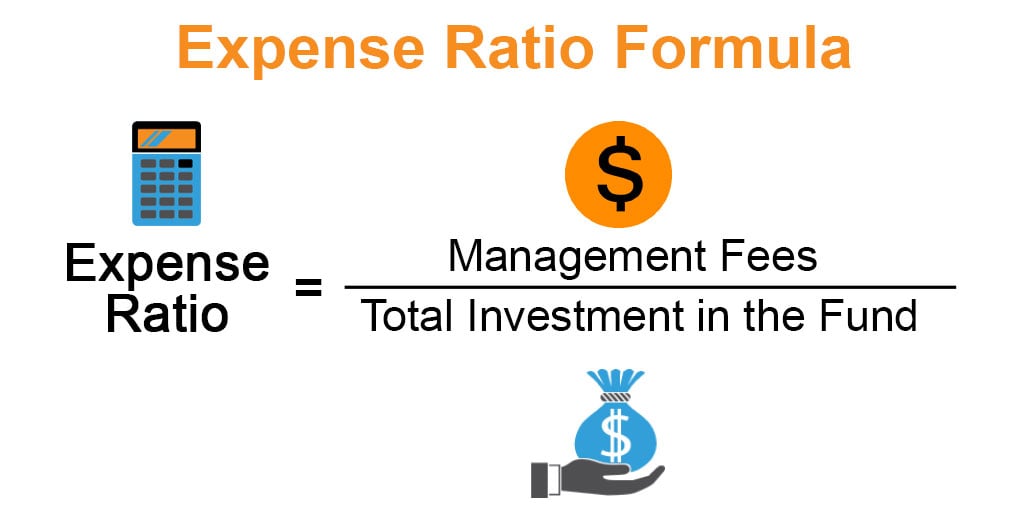

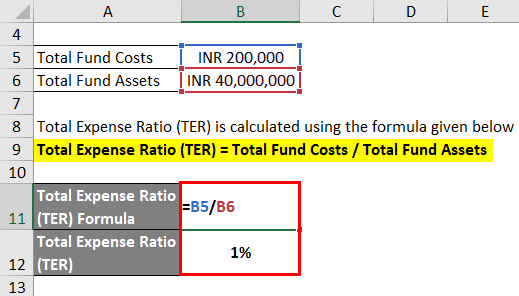

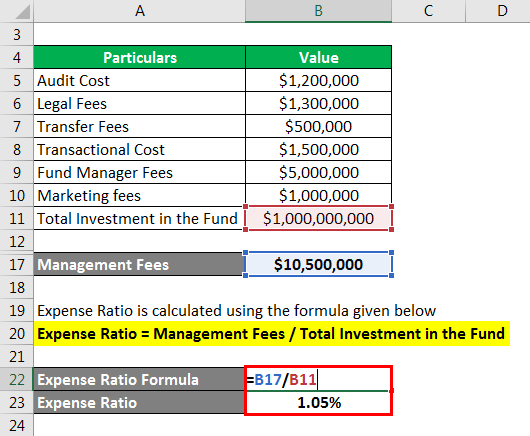

In real life that means if the fund spends 100000 a year on operating costs and has 10 million in assets its expense. The formula for Expense Ratio. Expense Ratio Total costs that are borne by the mutual fund Average assets under management Total costs that are borne by the fund The costs incurred by the AMC mentioned above like fund managers fee marketing and distribution expenses legalaudit costs.

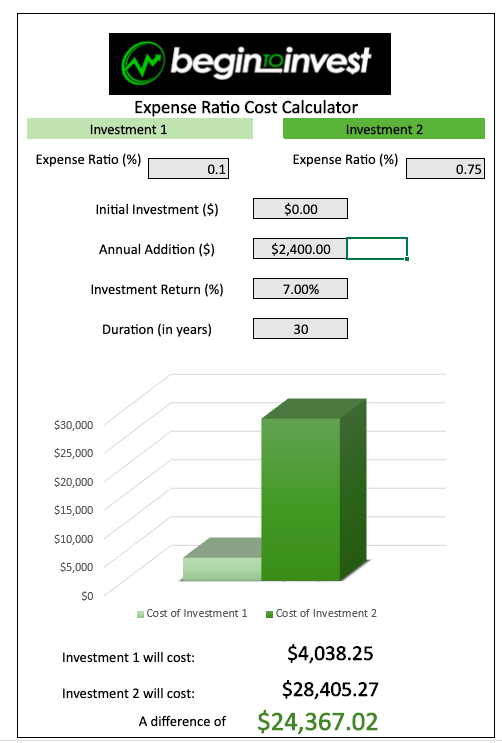

Following are the returns and the investment value. A difference of only 1100 one might think. Mutual Fund Expense Calculator.

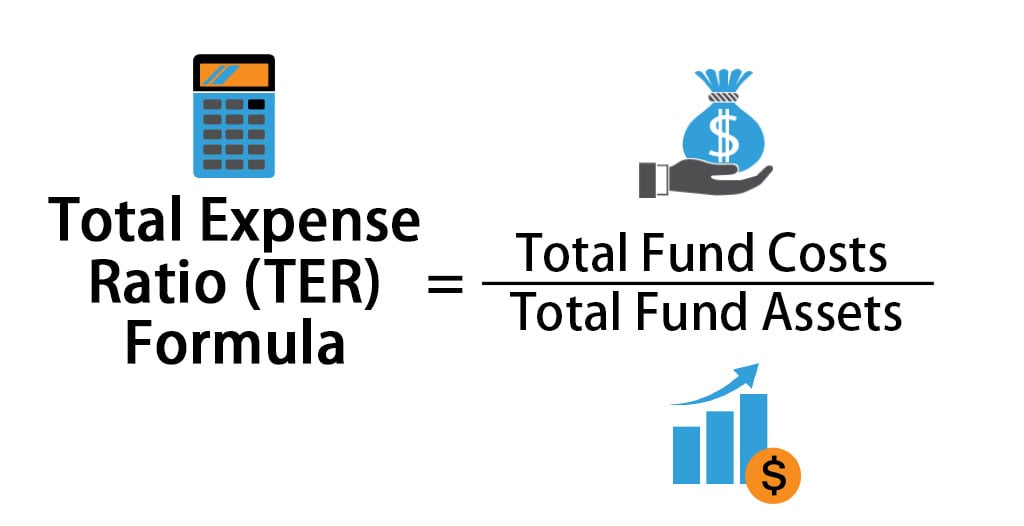

It usually ranges between 01 to 1 but it can go as low as 0045 like in the SPY case and up to 295 like in the case of Global X SuperDividend Alternatives ETF. Expense ratio Annual fund expenses Total assets under management. This represents a return of 89 not 10 1 as you might think.

The Operating Expense Ratio OER is calculated by dividing the annual fund operating expenses by the highest one-year total return of any portfolio he has ever published. Sometimes as per the companies demand it can be calculated or expressed in terms of per unit and therefore in that case the Net Asset Value for the beginning of the year and Net Asset Value at the end of the year is first. By law its calculated every year according to a set formula.

For an expense ratio of 2 the value will be 107800 or a net return of 78. The expense ratio can be used to compare funds within an. This tool estimates the value of the funds and impact of fees and expenses on your investment and also allows you the ability to look up applicable fees and available discounts for funds.

This calculator can help you analyze the costs associated with buying shares in a mutual fund. Index fund with expense ratio of 010 for reference Vanguards SP 500 ETF has expense ratio of 003 Actively managed mutual fund with expense ratio of 075. Expense Ratio Total expenses Average value of the portfolio.

Know the capital gain the maturity amount of your mf investments. Ad Prudential Offers Investments Designed To Keep Your Financial Life Moving Forward. Mutual Fund Expense Calculator.

The Mutual Fund expense ratio is calculated by dividing the total expense by the average value of the portfolio. For instance lets assume that the difference in the expense ratio between the direct and regular plan of a scheme is 075. Its expressed as a percentage of the funds assets and its calculated by dividing the annual operating expenses by the average net assets in the fund over a 12-month period.

All mutual funds have expenses which can range from as low as 010 for an index fund to as high as 40 or more for more complex strategies. The expense ratio is a fee charged by mutual funds and ETF providers for the concept of managing the assets in the fund. By entering a few pieces of information found in your funds prospectus you can see the impact of fees and operating expenses on your investment.

Expense Ratio of more than 15 is considered to be very high from an investors point of view. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Choosing funds with lower expenses wont guarantee you a better overall return but it will guarantee.

Mutual fund calculator helps you to calculate mutual fund returns on your investment. This calculator will show you how to calculate the profit ratio and provide an example with actual. Ad Learn More About American Funds Objective-Based Approach to Investing.

If a mutual fund quotes an expense ratio of 1 then 1 of 110000 that is 1100 will be deducted and the value shown in the statement will be 108900. Investments Include Mutual Funds College Savings Plans Personalized Portfolios More. In order to manage the fund the fund house charges management fee administrative.

We can call it the maintenance fee of the investment. Ad Calculate Your Potential Investment Returns With The Help Of AARPs Free Calculator. Choose From Over 60 Funds With 4 5 Star Ratings From Morningstar.

By entering a few pieces of information found in the funds prospectus view the impact. The Cost Calculator is great for understanding costs but costs arent the only thing that should be considered. The expense ratio is calculated by dividing the total expenses incurred by the average value of the portfolio.

ETFs usually have a lower expense ratio than pure mutual funds. Suppose there is a fund house that has an asset under management worth Rs. Youll almost always see it expressed as a percentage of the funds average net assets instead of a flat dollar amount.

An expense ratio reflects how much a mutual fund or an ETF exchange-traded fund pays for portfolio management administration marketing and distribution among other expenses. Heres a simple example I created on the calculator assuming the following. Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals.

Which is better a no-load fund with yearly expenses of 175 or a fund with a front-end sales charge of 35 with yearly expenses of 090.

Assets Under Management Aum Meaning Calculation Seeking Alpha

How To Calculate Expense Ratios Using Expense Ratio Calculator Youtube

Pin On Articles To Read

What Is Expense Ratio In Mutual Funds Components Formula Indmoney

Interactive Expense Ratio Calculator For Mutual Funds And Etfs Blog

Total Expense Ratio Formula Ter Calculator With Excel Template

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Swtsx Vs Swppx Which Schwab Index Fund Is Best In 2022 Stock Market Index Stock Market S P 500 Index

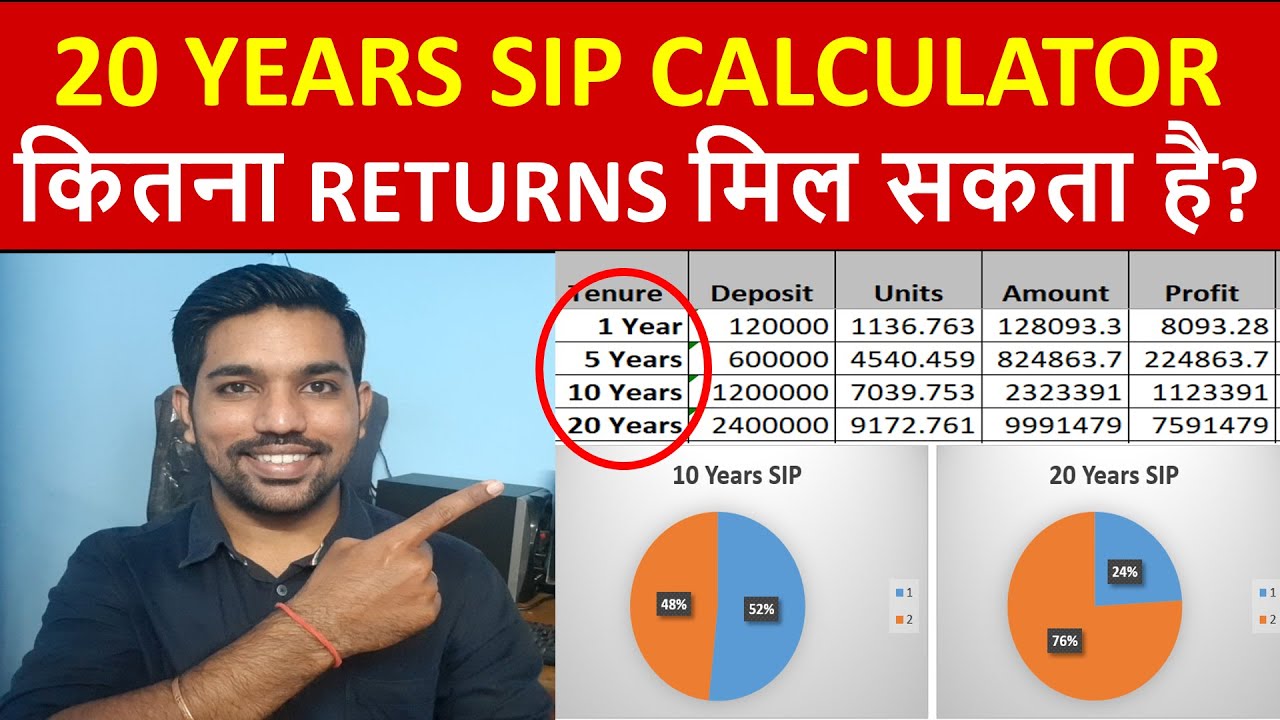

20 Years Sip Returns Excel Calculator Systematic Investment Plan Returns Calculation Youtube

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Expense Ratio Formula Calculator Example With Excel Template

Total Expense Ratio Formula Ter Calculator Excel Template

Total Expense Ratio Formula Ter Calculator Excel Template

Expense Ratio Calculator For Etfs

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Expense Ratio Formula Calculator Example With Excel Template